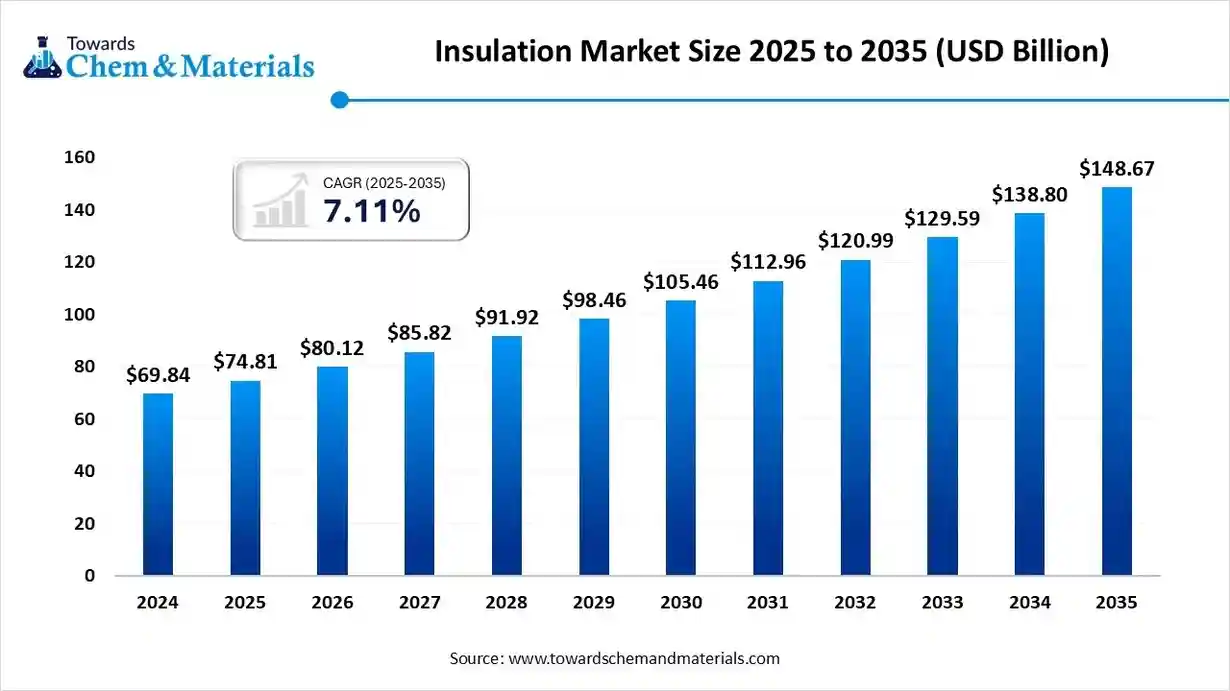

Insulation Market Size to Reach USD 148.67 Billion by 2035

According to Towards Chemical and Materials, the global insulation market size is estimated at USD 74.81 billion in 2025 and is anticipated to reach around USD 148.67 billion by 2035,growing at a compound annual growth rate (CAGR) of 7.11% over the forecast period from 2025 to 2035.

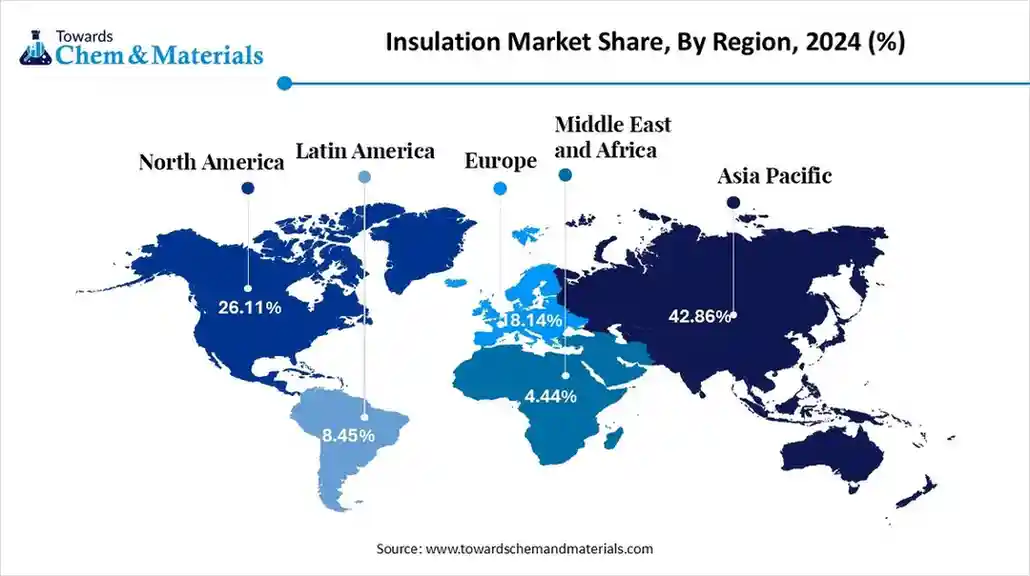

Ottawa, Nov. 06, 2025 (GLOBE NEWSWIRE) -- The global insulation market size was estimated at USD 69.84 billion in 2024 and is expected to surpass around USD 148.67 billion by 2035, growing at a compound annual growth rate (CAGR) of 7.11% over the forecast period from 2025 to 2035. Asia Pacific dominated the insulation market with a market share of 42.86% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5985

The Rising demand for energy efficient buildings driven by stricter environmental regulations is a key growth factor for the insulation market. The insulation market focuses on the development and distribution of materials designed to reduce heat transfer, sound transmission, and electrical conductivity across diverse applications such as construction, industrial facilities, and HVAC systems. Driven by rising awareness of energy conservation and sustainable building practices, the market continues to expand. Advancements in insulation technologies and the growing emphasis on energy-efficient infrastructure are propelling the demand for high-performance materials like fiberglass, mineral wool, and polyurethane foams.

Insulation Market Report Highlights

- By region, Asia Pacific dominated global insulation market with the largest share of 42.86% in 2024. The dominance of the region can be attributed to the surge in oil production in emerging economies like India and China.

- By region, North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the growing insulation demand from manufacturing, oil and gas, and power.

- By insulation type, the thermal insulation segment dominated the market in 2024. The dominance of the segment can be attributed to the growing demand for noise reduction, energy efficiency, and strict adherence to energy regulations.

- By insulation type, the acoustic insulation segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the ongoing construction developments, rapid urbanization, and raised awareness regarding noise pollution.

- By material type, the expanded polystyrene (EPS) segment held the largest market share in 2024. The dominance of the segment can be linked to the various benefits of expanded polystyrene across different sectors.

- By material type, the glass wool segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by various benefits of glass wool insulation.

- By end use, the building and construction sector segment dominated the insulation market in 2024. The dominance of the segment is owing to the rising number of insulation-intensive buildings in rural and urban areas.

- By end use, the transportation segment is expected to grow at a significant CAGR over the projected period. The growth of the segment is due to the growing need for energy-efficient vehicles, the growth of public transportation, and the surge in electric and hybrid vehicles.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5985

Insulation Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 80.12 Billion |

| Revenue forecast in 2035 | USD 148.67 Billion |

| Growth rate | CAGR of 7.11% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2025 - 2035 |

| Forecast period | 2025 - 2035 |

| Quantitative units | Volume in Kilotons, Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Segments covered | By Insulation Type, By Material Type, By End User, By Region |

| Regional scope | North America; Asia Pacific; Europe; Central & South America; Middle East & Africa |

| Key companies profiled | GAF Materials Corp.; Huntsman International LLC; Johns Manville; Cellofoam North America, Inc.; Rockwool International A/S; DuPont; Owens Corning; Atlas Roofing Corporation; Saint-Gobain S.A.; Kingspan Group; BASF; Knauf Insulation; Armacell International Holding GmbH; URSA; Covestro AG; Recticel NV/SA; Carlisle Companies, Inc.; Bridgestone Corporation; Fletcher Building; 3M Company |

Why is insulation important?

Insulation acts as a barrier to heat flow and is essential for keeping your home warm in winter and cool in summer. A well-insulated and well-designed home provides year-round comfort, cutting cooling and heating bills, and reducing greenhouse gas emissions.

Insulation R values

How well an insulation product resists heat flow is know as its R value. The higher the R value, the higher the level of insulation. The appropriate degree of insulation depends on your climate, building construction type, and whether auxiliary heating and/or cooling is to be used.

Material R values refer to the insulating value of the product alone. The NCC and BASIX (in New South Wales) set out minimum requirements for the R values of materials used in the construction of buildings. It is generally advisable to exceed these for greater comfort and energy savings.

Total R value

‘Total R value’ describe the total resistance to heat flow provided by a roof and ceiling assembly, a wall or a floor. Each of the material components has its own heat resistance (R value), and the total R value is calculated by adding the R value of each component, including the insulation.

Total R values are the best indicator of performance because they show how insulation performs within the building envelope. Total R values are used when calculating energy ratings to measure thermal efficiency.

Total R values for roofs, ceilings and floors that use reflective insulation are expressed as up and down values, depending on the direction of heat flows through the product:

- ‘Up’ R values describe resistance to heat flow in an upwards direction (sometimes known as ‘winter’ R values).

- ‘Down’ R values describe resistance to heat flow in a downwards direction (sometimes known as ‘summer’ R values).

Both up and down R values should be considered when installing roof, ceiling and floor insulation. Total R values for walls are expressed as a single figure, without ‘up’ and ‘down’ distinctions.

Many factors can reduce the total R value, including thermal bridging, compression of bulk insulation, dust settling on reflective insulation and the lack of a suitable air gap for reflective surfaces. Careful installation according to specifications is needed to ensure your insulation performs as it should.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5985

Types of Insulation in market

| Type | Material | Where Applicable | Installation Methods | Advantages |

| Blanket: batts and rolls | Fiberglass Mineral (rock or slag) wool Plastic fibers Natural fibers |

Unfinished walls, including foundation walls Floors and ceilings |

Fitted between studs, joists, and beams. | Do-it-yourself. Suited for standard stud and joist spacing that is relatively free from obstructions. Relatively inexpensive. |

|

Concrete block insulation and insulating concrete blocks |

Foam board, to be placed on outside of wall (usually new construction) or inside of wall (existing homes): Some manufacturers incorporate foam beads or air into the concrete mix to increase R-values |

Unfinished walls, including foundation walls New construction or major renovations Walls (insulating concrete blocks) |

Require specialized skills Insulating concrete blocks are sometimes stacked without mortar (dry-stacked) and surface bonded. |

Insulating cores increases wall R-value. Insulating outside of concrete block wall places mass inside conditioned space, which can moderate indoor temperatures. Autoclaved aerated concrete and autoclaved cellular concrete masonry units have 10 times the insulating value of conventional concrete. |

| Foam board or rigid foam | Polystyrene Polyisocyanurate Polyurethane Phenolic |

Unfinished walls, including foundation walls Floors and ceilings Unvented low-slope roofs |

Interior applications: must be covered with 1/2-inch gypsum board or other building-code approved material for fire safety. Exterior applications: must be covered with weatherproof facing. |

High insulating value for relatively little thickness. Can block thermal short circuits when installed continuously over frames or joists. |

| Insulating concrete forms (ICFs) | Foam boards or foam blocks | Unfinished walls, including foundation walls for new construction | Installed as part of the building structure. Cores in the blocks are typically filled with concrete to create the structural component of the wall. | Insulation is literally built into the home's walls, creating high thermal resistance. |

| Loose-fill and blown-in | Cellulose Fiberglass Mineral (rock or slag) wool |

Enclosed existing wall or open new wall cavities Unfinished attic floors Other hard-to-reach places |

Blown into place using special equipment and, although not recommended, sometimes poured in. | Good for adding insulation to existing finished areas, irregularly shaped areas, and around obstructions. |

| Reflective system | Foil-faced kraft paper, plastic film, polyethylene bubbles, or cardboard | Unfinished walls, ceilings, and floors | Foils, films, or papers fitted between wood-frame studs, joists, rafters, and beams. | Do-it-yourself. Suitable for framing at standard spacing. Bubble-form suitable if framing is irregular or if obstructions are present. Most effective at preventing downward heat flow, effectiveness depends on spacing and number of foils. |

| Rigid fibrous or fiber insulation | Fiberglass Mineral (rock or slag) wool |

Ducts in unconditioned spaces Other places requiring insulation that can withstand high temperatures |

HVAC contractors fabricate the insulation into ducts either at their shops or at the job sites. | Can withstand high temperatures. |

| Sprayed foam and foamed-in-place | Cementitious Phenolic Polyisocyanurate Polyurethane |

Enclosed existing wall Open new wall cavities Unfinished attic floors |

Applied using small spray containers or in larger quantities as a pressure sprayed (foamed-in-place) product. | Good for adding insulation to existing finished areas, irregularly shaped areas, and around obstructions. |

| Structural insulated panels (SIPs) | Foam board or liquid foam insulation core Straw core insulation |

Unfinished walls, ceilings, floors, and roofs for new construction | Construction workers fit SIPs together to form walls and roof of a house. | SIP-built houses provide superior and uniform insulation compared to more traditional construction methods; they also take less time to build. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

How Insulation Works

To understand how insulation works, it's essential to recognize the flow of heat, which involves three key mechanisms: conduction, convection, and radiation. Conduction is the process by which heat travels through materials, such as when a spoon in a hot cup of coffee conducts heat to your hand. Convection is how heat circulates through liquids and gases, which is why warm air rises and cooler air sinks in your home. Radiation, on the other hand, involves heat traveling in a straight line and warming any solid objects in its path that absorb the energy.

Most common insulation materials work by slowing down the flow of heat through conduction and convection. Radiant barriers and reflective insulation systems help reduce radiant heat gain. For these systems to be effective, the reflective surface needs to be in contact with an air space.

Regardless of the heat transfer method, heat always moves from warmer areas to cooler ones. This means that in winter, heat escapes from heated spaces into unheated areas like attics, basements, or even the outdoors. Heat can also move through ceilings, walls, and floors when there is a temperature difference. In summer, the process reverses, with heat flowing from the outside to the inside of a house.

To maintain a comfortable environment, the heat lost in winter must be replaced by the heating system, and the heat gained in summer must be countered by the cooling system. Proper insulation plays a critical role in reducing heat flow, ensuring your home remains energy-efficient and comfortable year-round, ultimately protecting the well-being of the inhabitants.

Insulation Materials

Learn about the following insulation materials:

-

Fiberglass:

- Environmental Impact: The production of fiberglass can involve the release of chemicals and pollutants, which can contribute to environmental degradation.

- Worker Health Risks: Exposure to fiberglass dust can cause respiratory issues for workers in manufacturing plants.

- Sustainability: While fiberglass itself is not biodegradable, it can be recycled, though the process is not widespread.

- Human Rights Consideration: Ensuring safe working conditions and controlling emissions in production is critical.

-

Mineral Wool:

- Health and Safety: Like fiberglass, mineral wool can release harmful dust that may pose health risks to workers, such as respiratory issues or skin irritation.

- Sustainability: Mineral wool is often made from natural rock or slag, which can be seen as more environmentally friendly compared to synthetic materials.

- Labor Rights: There should be measures to protect workers from exposure to these materials, particularly in developing countries where labor laws might be weaker.

-

Cellulose:

- Sustainability: Cellulose insulation is made from recycled paper, making it a more sustainable choice. It’s biodegradable and energy-efficient.

- Health Risks: It is generally considered safe, but the dust produced during installation may cause respiratory irritation.

- Worker Safety: Ensuring safety protocols for those working with cellulose to prevent inhalation of fibers is essential.

-

Natural Fibers (Cotton, Hemp, Sheep’s Wool, etc.):

- Sustainability: Natural fibers are biodegradable, renewable, and generally considered more environmentally friendly.

- Labor Rights: Fair labor practices are crucial in harvesting and processing these fibers, particularly in countries with less stringent labor laws.

- Human Health: Natural fibers are typically safer to handle than synthetic alternatives, but care should still be taken during production and handling.

-

Polystyrene (EPS/XPS):

- Environmental Impact: Polystyrene is not biodegradable, and its production contributes to plastic waste. It can also release harmful chemicals during manufacturing.

- Worker Health and Safety: Workers involved in the production of polystyrene may be exposed to toxic chemicals, including styrene.

- Recycling and Disposal: Polystyrene is difficult to recycle and often ends up in landfills, contributing to pollution.

- Human Rights Consideration: There is a need for greater emphasis on the ethical sourcing of raw materials and responsible production practices to protect workers and the environment.

-

Polyisocyanurate (PIR):

- Environmental Impact: PIR is a type of foam insulation with a high R-value, but its production involves chemicals that can be harmful to the environment.

- Health Risks: The manufacturing process involves isocyanates, which can pose serious health risks to workers if not handled properly.

- Human Rights Concerns: The use of harmful chemicals in the production process requires strict regulation to protect both workers and local communities.

-

Polyurethane:

- Environmental Impact: Polyurethane is derived from petroleum, and its production is energy-intensive and contributes to environmental pollution.

- Health and Safety: Like PIR, the chemicals involved in polyurethane production can be hazardous to workers.

- Recycling: Polyurethane is difficult to recycle, which increases its environmental footprint after disposal.

-

Perlite:

- Sustainability: Perlite is a natural, volcanic mineral that is non-toxic and environmentally friendly.

- Health Risks: There are few health risks associated with perlite, although dust can irritate the lungs if inhaled during installation.

- Worker Protection: Since perlite is non-toxic, its use is generally safer, but adequate dust control measures are still necessary.

-

Cementitious Foam:

- Health and Safety: Cementitious foam is typically made from non-toxic materials, but handling and exposure to dust during production and installation could be harmful.

- Environmental Impact: Cement-based products are energy-intensive and contribute to carbon emissions, but cementitious foam can have lower environmental impact compared to traditional concrete.

- Worker Rights: Proper health and safety measures must be in place to ensure workers’ protection from dust exposure and to avoid labor exploitation.

- Phenolic Foam:

- Environmental Impact: Phenolic foam has a high R-value, but its production is energy-intensive and may involve harmful chemicals.

- Health Risks: The production and installation of phenolic foam can pose risks to workers if safety standards are not met, particularly from exposure to formaldehyde.

- Worker Safety: Strong worker protections must be enforced to avoid exposure to potentially hazardous chemicals.

- Insulation Facings (Aluminum, Foil, Plastic, etc.):

- Sustainability: The sustainability of insulation facings depends on the material used. Aluminum facings are recyclable, while plastic facings may not be.

- Worker Rights: The production of these facings can involve labor exploitation, particularly in regions with weaker labor laws. Ethical sourcing and labor practices should be prioritized.

- Environmental Impact: Facings like aluminum are more eco-friendly than plastic ones, which can contribute to pollution.

General Human Rights Considerations for Insulation Materials:

- Fair Labor Practices: Workers in the insulation materials industry, especially in developing countries, should be paid fair wages, work in safe conditions, and have access to necessary protective gear.

- Health and Safety Standards: Both workers and consumers should be protected from exposure to harmful chemicals in insulation materials. This includes safe working conditions in production plants and proper handling of materials during installation.

- Environmental Sustainability: The production, use, and disposal of insulation materials should minimize environmental harm. This includes reducing emissions, recycling materials, and using renewable resources when possible.

- Ethical Sourcing: Companies should ensure that the raw materials for insulation products are sourced ethically, avoiding exploitation or harm to vulnerable communities.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5985

What Are the Major Trends In The Insulation Market?

- Growing adoption of insulation materials in electric and hybrid vehicles to enhance thermal management, energy efficiency, and passenger comfort.

- Rapid expansion of the construction sector and government-driven infrastructure projects are boosting the demand for high-performance insulation products.

- Increasing emphasis on energy efficiency and sustainability is driving the use of advanced insulation materials in residential and industrial applications.

- Emergence of innovative insulation technologies such as aerogels, vacuum insulation panels, and phase change materials offering superior performance and efficiency.

How Does AI Influence the Growth Of The insulation Market In 2025?

Artificial intelligence is transforming the insulation market by optimizing material design, production efficiency, and energy management. Through predictive analytics and simulation, AI helps manufacturers develop advanced insulation materials with improved thermal and acoustic properties. It also enables real-time monitoring of manufacturing processes, reducing waste and ensuring consistent product quality.

Moreover, AI-driven automation supports the construction and building sectors by integrating smart insulation systems that adapt to environmental conditions. These intelligent solutions enhance energy efficiency, promote sustainability, and align with the growing trend of green infrastructure.

Growth Factors

Why Are Stricter Building Codes Driving Insulation Demand?

Tighter energy regulations are pushing builders to adopt efficient insulation materials to meet sustainability goals and reduce energy loss. Governments worldwide are enforcing standards for walls, roofs, and HVAC systems, making insulation a core requirement in construction.

How Are Electric Vehicles Fuelling New Insulation Needs?

The rise of electric vehicles is increasing the demand for advanced insulation to manage battery heat, ensure safety, and boost performance. This trend is expanding insulation use beyond buildings into the automotive sector.

Market Opportunity

What Opportunity Does Building Renovation Create For Insulation?

The drive to upgrade existing structures presents an opening for high-performance insulation to become standard in retrofits focused on energy efficiency and comfort. Approaches that combine insulation with broader sustainability goals are gaining traction across residential and commercial projects. The move toward climate-resilient building envelopes gives insulation providers a broader scope beyond new construction. This way shifts focus toward solutions tailored for existing or inefficient buildings.

Where Can Advanced Martials Expand Insulation’s Reach?

Emerging materials such as aerogels, nanocomposites, and bio-based foams unlock applications in sectors previously unserved by traditional insulation. These innovations offer enhanced performance while meeting sustainability demands, opening opportunities in automotive, aerospace, and smart structures. Suppliers equipped to integrate these advanced materials stand to access new use cases and differentiate their offerings. This could reshape material supply chains and collaboration across industries.

Limitations in The Insulation Market

- High installation and material costs can restrict adoption, especially in small-scale projects and developing regions where budget constraints limit the use of advanced insulation solutions.

- Limited awareness about long-term energy savings and importer installation practices can reduce insulation efficiency and hinder market expansion.

Insulation Market Segmentation Insights

Insulation Type Insights:

Which Segment Dominates in Insulation Market?

The thermal insulation segment maintained dominance in the market, driven by increasing emphasis on energy conservation and temperature regulation across commercial, residential, and industrial projects. Growing urbanization and expanding infrastructure in emerging economies have accelerated the use of thermal insulation in walls, roofs, and flooring systems. The material’s ability to reduce heat loss and limit sound transmission has made it a preferred solution for sustainable and energy-efficient building designs. Additionally, the adoption of green construction standards continues to elevate the use of thermal insulation materials across multiple applications.

The acoustic insulation segment is emerging as the fastest-growing category in the market, supported by rising awareness of noise control and comfort in urban environments. Expanding construction of residential complexes, commercial offices, and industrial spaces has boosted the demand for soundproof materials that enhance privacy and meet regulatory standards. Acoustic insulation is increasingly viewed as a necessity in densely populated areas. Minimizing noise pollution has become a key component of building design. Moreover, leading manufacturers are innovating with advanced materials that deliver improved acoustic performance while supporting energy efficiency goals.

Material Type Insights:

Which Segment Dominated the Insulation Market?

The expanded polystyrene (EPS) segment continues to dominate the insulation market owing to its versatility, durability, and cost-effectiveness. EPS offers superior thermal insulation, lightweight properties, and resistance to moisture and chemicals, making it suitable for a wide range of applications in construction and packaging. Its recyclability and ease of installation further support its use in sustainable building solutions. As environmental awareness grows, EPS materials are being optimized for better efficiency and longer service life, strengthening their role in modern insulation systems.

Which Segment Is Growing Fastest In The Insulation Market?

The glass wool segment is anticipated to be the fastest growing in the insulation market, driven by its excellent thermal performance, fire resistance, and environmental benefits. Glass wool is valued for its non-combustible nature and ability to provide superior comfort by maintaining consistent indoor temperatures. Its growing adoption in both residential and industrial applications aligns with increasing demand for eco-friendly insulation materials. Manufacturers are also focusing on improving recyclability and production efficiency, which enhances the appeal of glass wool in sustainable construction projects.

End-Use Industry Insights:

Which Segment Dominates in the Insulation Market?

The building and construction segment has captured the largest share of the insulation market due to the rising emphasis on energy efficiency in new and retrofitted structures. The need to reduce heating and cooling costs, alongside stricter energy codes, has increased insulation use in homes, offices, and industrial buildings. Insulation materials are now integral to maintaining indoor comfort and reducing environmental impact. The sector’s expansion is further supported by urbanization trends and the growing shift toward smart and sustainable architecture.

The transportation segment is expected to experience the fastest growth in the insulation market, propelled by the rising demand for lightweight, energy-efficient vehicles and the rapid adoption of electric and hybrid models. Automotive manufacturers are integrating insulation solutions to enhance cabin comfort, reduce vibration, and maintain optimal battery performance. This shift aligns with global sustainability efforts, as efficient insulation helps improve energy usage and safety in vehicles. The trend is encouraging collaboration between insulation producers and automotive innovators to develop next-generation thermal and acoustic solutions.

Regional Insights

Why Is Asia Pacific Dominating the Insulation Market?

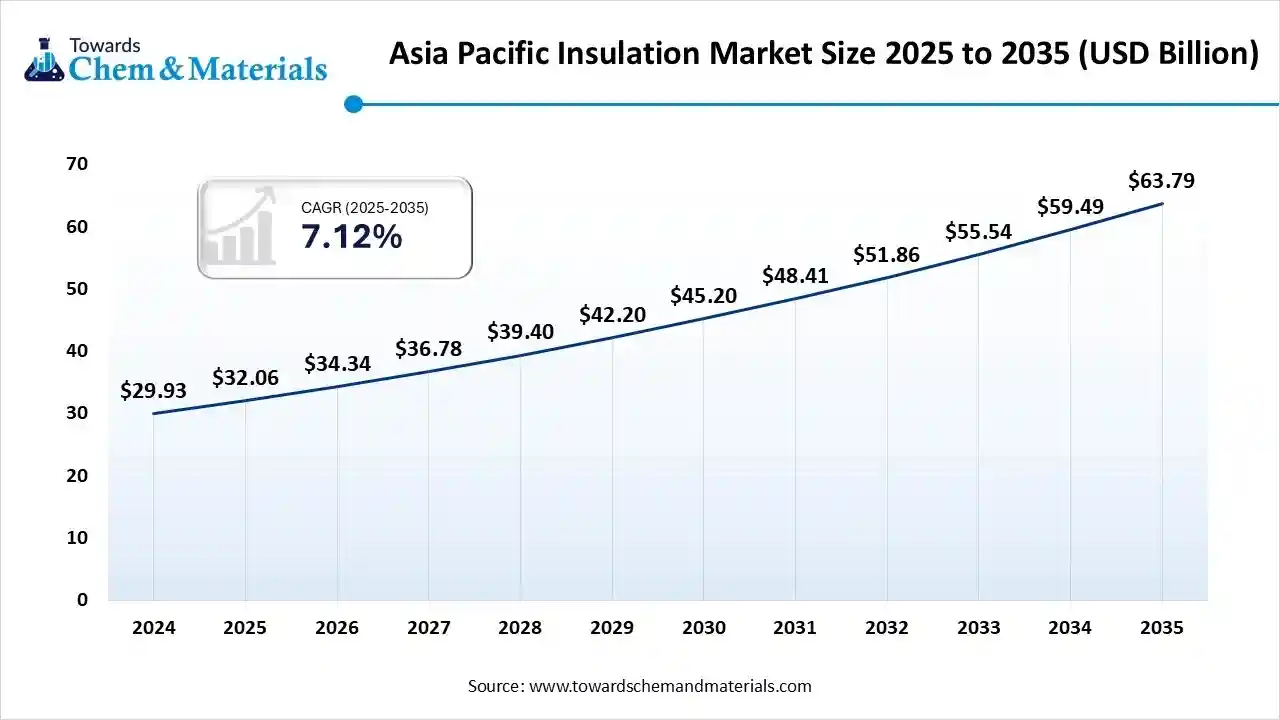

The Asia Pacific insulation market size was valued at USD 32.06 billion in 2025 and is expected to reach USD 63.79 billion by 2035, growing at a CAGR of 7.12% from 2025 to 2035. Asia Pacific held the largest insulation market share in 2024.

Asia Pacific dominated the market in 2024, due to rapid industrialization, expanding construction activities, and a strong focus on reducing energy losses. Governments across the region are implementing strict environmental policies aimed at cutting greenhouse gas emissions, which is increasing the adoption of energy-efficient materials. In addition, regional manufacturers are investing in maintenance and efficiency improvements to enhance sustainability and performance across industries.

China plays a central role in driving insulation market growth within the Asia Pacific, supported by increasing demand for thermal management, soundproofing, and energy efficiency in buildings, manufacturing plants, and appliances. Continuous advancements in insulation technologies and materials are promoting the use of sustainable and high-performance solutions. With rising urban development and environmental awareness, China is solidifying its position as a key contributor to the region’s insulation market expansion.

Why Is North America the Fastest Growing Region In The Insulation Market?

North America is emerging as the fastest-growing region in the market, driven by robust industrial demand from sectors such as manufacturing, oil, and gas, and power generation, where high operating temperatures require efficient insulation solutions. The region’s steady economic growth and continued investments in infrastructure, construction, and sustainability are also encouraging industries and builders to adopt advanced insulation technologies.

The United States plays a pivotal role in propelling the insulation market across North America, supported by stricter energy efficiency regulations and a surge in real estate development. Growing demand for modern residential and commercial spaces, particularly in major urban centres, is driving the need for effective insulation systems. Leading companies such as Owens Corning and Knauf Insulation are focusing on innovation and partnerships to expand their market presence and meet the evolving insulation requirements across the country.

Europe Insulation Market Trends

The insulation market in Europe benefits from stringent environmental laws and incentives under the EU Green Deal. Retrofitting aging infrastructure in Germany, France, and the UK plays a key role. Mineral wool, glass wool, and rigid foams dominate, while organic and recycled materials are growing in share. Acoustic insulation demand is high due to urban noise concerns. Passive house construction norms in countries like Austria and Sweden encourage High-R insulation. Fire safety regulations post-Grenfell have accelerated the use of non-combustible insulation.

The Germany insulation market accounted for the largest market revenue share in Europe in 2024, due to strong building codes, retrofitting programs, and widespread passive house adoption. Government incentives for energy upgrades and decarbonization goals are major drivers. Mineral wool and wood fiber insulation are preferred due to sustainability and fire safety. The country also emphasizes locally sourced, low-emission materials. Industrial insulation demand comes from automotive and manufacturing facilities. Circular economy principles influence insulation material choices, promoting recyclability.

Central & South America Insulation Market Trends

The insulation market in Central & South America is witnessing gradual market growth, led by Brazil and Mexico. Urbanization, infrastructure upgrades, and rising awareness of energy savings contribute to demand. The market is still developing, with cost-effective materials like EPS and fiberglass being widely used. Government policies are not as strict as in developed regions, but sustainability initiatives and foreign investment in green construction are encouraging growth. Climatic variations across the continent drive varying insulation needs in different countries.

Middle East & Africa Insulation Market Trends

The insulation market in the Middle East & Africa region is adopting insulation mainly for thermal protection in extreme climates and energy efficiency in buildings. GCC countries like the UAE and Saudi Arabia are mandating green building codes, boosting insulation demand. Fiberglass and polyurethane foams are commonly used in commercial and industrial projects. Africa’s market is smaller but growing, with infrastructure development in South Africa, Kenya, and Nigeria pushing basic insulation uptake. Demand from oil & gas and refrigerated storage adds industrial value.

More Insights in Towards Chemical and Materials:

- Bio-Based Polyurethane Market Size & Share Report, 2034

- Extruded Polystyrene Market : Demand, Production, and Future Projections

- Recycled Polystyrene Market - Current Status and Future Innovations

- Polystyrene Market : Demand, Production, and Future Projections

- Expandable Polystyrene Market: Demand, Production, and Future Projections

- Polysilicon Market Prices, News, Monitor, Market Analysis & Demand

- Polymers Market: Demand, Production, and Future Projections

- Polymers Market: Demand, Production, and Future Projections

- Liquid Crystal Polymers Market Outlook, In-Depth Analysis & Forecast to 2025-2034

- Water Treatment Polymers Market Prices, News, Monitor, Market Analysis & Demand

- Bioresorbable Polymers Market : Demand, Production, and Future Projections

- Industrial Water Treatment Market Size | Companies Analysis 2025- 2035

- Packaged Wastewater Treatment Market Size | Companies Analysis 2025- 2035

- Produced Water Treatment Market Size | Companies Analysis 2025- 2035

- Water Treatment Systems Market Size | Companies Analysis 2025- 2035

- Polymer Coated Fabrics Market Size | Companies Analysis 2025 - 2035

- Geotextiles Market Size | Companies Analysis 2025- 2035

- Industrial Water Treatment Chemical Market Size | Companies Analysis 2025 - 2035

- Wastewater Treatment Services Market Size | Companies Analysis 2025-2034

- U.S. Fertilizers Market Size | Companies Analysis 2025-2034

- Europe Textile Market Size | Companies Analysis 2025-2034

- Specialty Alumina Market Size | Companies Analysis 2025- 2034

- U.S. Textile Market Size | Companies Analysis 2025-2034

- Asia Pacific Nitrogenous Fertilizer Market Size | Companies Analysis 2025-2034

Insulation Market Top Key Companies:

- GAF Materials Corporation

- Huntsman International LLC

- Johns Manville

- Cellofoam North America, Inc.

- Rockwool International A/S

- DuPont

- Owens Corning

- Atlas Roofing Corporation

- Saint-Gobain S.A.

- Kingspan Group

- BASF

- Knauf Insulation

- Armacell International Holding GmbH

- URSA

- Covestro AG

- Recticel NV/SA

- Carlisle Companies, Inc.

- Bridgestone Corporation

- Fletcher Building

- 3M Company

Recent Developments

- In October 2025, the insulation market saw a notable consolidation when TopBuild Corp acquired Specialty Products and Insulation (SPI) in a cash deal worth about one billion dollars, signalling a strategic by TopBuild to strengthen is mechanical and building insulation fabrication footprint.

- In October 2025, in Europe, Holcim Group announced its intention to purchase Xells Group, a specialist in walling systems and insulation materials, enhancing Holcim’s access to the building refurbishment market focused on improving energy efficiency of older buildings.

Insulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Insulation Market

By Insulation Type

- Thermal Insulation

- Acoustic Insulation

By Material Type

- Glass Wool

- Mineral Wool

- Expanded polystyrene (EPS)

- Extruded polystyrene foam insulation (XPS)

- Calcium-Magnesium-Silicate (CMS) Fibers

- Calcium Silicate

- Polyurethane

- Aerogel

- Others (Cellulose, Phenolic Foam, etc.)

By End User

- Building and Construction

- HVAC and OEM

- Transportation

- Appliances

- Others (Furniture, Packaging, etc.)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5985

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.